- News

- Subscribe

Get full access to The Motorship content

Including the digital magazine, full news archive, podcasts, webinars and articles on innovations and current trends in the shipping industry.

- Expert analysis and comment

- Unlimited access to in-depth articles and premium content

- Full access to all our online archive

Alternatively REGISTER for website access and sign up for email alerts

- White Papers

- Industry Database

- Events

Propulsion & Future Fuels Conference

Green Ports & Shipping Congress

The Motorship’s Propulsion & Future Fuels is the leading international conference on powering shipping’s emissions-cutting ambitions. The Green Ports & Shipping Congress will identify and prioritise the areas that ports-based organisations and shipping companies need to collaborate on to reduce emissions. Visit the PFF Website Visit the GPSC Website

Close menu

- Home

- News

- Subscribe

- White Papers

- Industry Database

- Events

‘Major risks remain’ as sulphur cap nears

2018-06-28T07:45:00

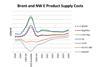

The introduction of the IMO’s global sulphur cap still poses a big risk to shipping and the global economy as 2020 nears, say the authors of the supplemental marine fuel availability study.

Continue this article…

Already subscribed? SIGN IN now

Sign up for FREE to continue this article!

Want to read more before deciding on a subscription? It only takes a minute to sign up for a free account and you’ll get to enjoy:

- Weekly newsletters providing valuable news and information on the shipping sector

- Full access to our news archive

- Live and archived webinars, podcasts and videos

- Articles on innovations and current trends in the shipping industry

- Our extensive archive of data, research and intelligence

Get more free content sign up today

Ready to subscribe? Choose from one of our subscription packages for unlimited access!