At Nor-Shipping, we spoke to Tore Svanheld (pictured), CEO of Optimarin and Tonje Olafsen, VP sales and projects at Optimarin about the ballast water treatment service market following their company’s release of its Guardian system. This came after Optimarin’s acquisition of Hyde Marine which may not be the last deal the company does as BWTS providers consolidate.

The global BWTS market is surging despite Svanheld saying that it is more geared for newbuilds as shipowners seeking retrofits to comply with regulations would most probably have done so by now. With some forecasts projecting a rise from over $140 billion in 2025 to more than $426 billion by 2029—a CAGR of 32%—innovation and efficiency are key drivers. With approximately 40–50 IMO‑ and USCG‑approved ballots suppliers today, optimism prevails for a consolidation wave, with only 15–20 providers projected to remain according to Svanheld.

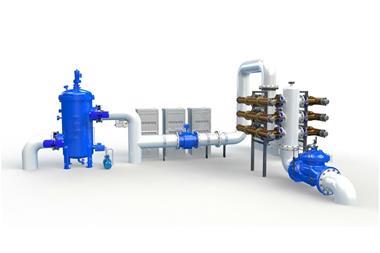

Amid this transformation, Norway’s Optimarin is asserting itself as a market frontrunner due in no small part to its acquisition of Hyde Marine from De Nora, adding not just UV‑based technology, IP, and certifications, but one of the industry’s largest fleet bases—to the tune of around 600 systems. Combined with Optimarin’s existing circa 1,400 BWTS installations, the expanded footprint now boasts approximately 2,000 systems.

As Svanheld explains: “We took over the technology with the certificates, IP rights, things like that. And also the installed base of existing systems … so we have responsibility to take service and spare parts for all the Hyde marine systems.” This strategic move delivers instant scale in service and aftermarket support—a clear fleet play.

Bolstering Asian footprint

Optimarin’s existing presence in Asia—offices in Shanghai and Singapore—proved invaluable during the integration. “We already had the Asian market because we had an office in Shanghai already, so it didn’t create any new market for us,” Svanheld notes. With “very good service and organisation” already established, transitioning Hyde’s install base in the region was seamless.

This advantage is no bluff: Asia-Pacific is reported to account for around 39% of BWTS market revenues, so Optimarin’s local infrastructure—including a manufacturing base in China—is a strong competitive asset.

Widening the remit and bolstering digitalisation offering

Prior to the acquisition, Optimarin’s systems served primarily medium-to-large vessels—and struggled in smaller segments due to non-competitive pricing or bulky UV chambers. Now, with Hyde’s compact “Guardian”-inspired UV units capable of flows as low as 60 m³/h, the company is targeting yachts, fishing boats, and small workboats. As Olafsen puts it:

“Now we have… technology in the lower ranges, which is down to 60 cubics per hour… Compact UV chamber … for smaller vessels, like yachts and for fishing vessels, we can enter this market.”

At the other end, Optimarin has simplified larger systems—from multiple UV power cabinets to just one—reducing power consumption and cutting owners’ operational costs.

Optimarin has also capitalised on digital, cloud-based connectivity. Its OptiLink™ system enables GPS-linked data capture during ballasting—allowing voyage planning around port water quality—and full remote diagnostics. This yields two key benefits, firstly shipowners gain foresight: “they [shipowner] can plan… ‘do we need to do the ballasting before we enter the harbour…’” and the all important cost savings digitalisation can bring. Olafsen says: “We can do remote servicing, download and update the software, without bringing [an engineer] onboard. That’s a huge benefit.”

Market outlook

The BWTS sector is shifting from buoyant retrofit demand to consolidation and smart servicing. Svanheld believes:

“Ballast water treatment service suppliers in the market, after a huge retrofit wave… there is around 40 to 50 approved suppliers… all these companies with few installations… may not be there in the future… so we will see more consolidation… maybe 15–20 providers.”

Optimarin is positioning to emerge stronger. With a dense service network, hybrid product portfolio, growing installed base, digital capabilities, and now access to smaller-vessel markets, the company is ready to increase market share. As Svanheld has it:

“We will grow in the ballast water treatment market… we have the existing instrument service setup and infrastructure… it’s easiest for us to adapt all those systems into our portfolio, and new services very much in the future.”

Optimarin’s journey—from pioneer of BWTS to consolidator of its own niche—is textbook strategic evolution. The Hyde Marine takeover delivered scale and new technologies. The established presence in Asia, refined product range for small and large vessels, plus smart utilisation of remote monitoring, rivals the progression from mere supplier to full-service, digital OEM.

As consolidation shrinks the supplier universe to 15–20 players, Optimarin looks built to be among them—and arguably, among the strongest. Expect to see them leverage this momentum to win newbuild, and servicing contracts across the global fleet.