The past year proved to be a defining one for the maritime sector, marked by the entry into force of long-anticipated regulation, intensifying debate at the International Maritime Organization and a steady undercurrent of investment in future fuels and efficiency technologies, although doubts linger as to whether this will continue.

From the implementation of new EU rules, namely FuelEU Maritime, in January to unresolved global negotiations in October and a collective industry reset towards the end of the year, 2025 underlined both the pace and complexity of the transition now facing shipping. What follows is a review of some of the key developments that shaped the market over the year, alongside pointers to coverage you may wish to revisit.

January 2025

FuelEU Maritime finally entered into force at the start of the year, bringing with it a regulation that had been both anticipated and feared in equal measure. Years of technical refinement had gone into shaping the framework, yet concerns remained widespread across the industry, from publicly listed groups to smaller private operators, about cost exposure, data requirements and operational flexibility.

As the regulation took effect, a growing ecosystem of compliance and optimisation providers moved quickly to position themselves as partners for shipowners navigating the new regime. Wärtsilä, for example, released its EU Emissions Compliance module within its Fleet Optimisation Solution platform, integrating FuelEU Maritime requirements alongside EU ETS. Using its Smartlog technology, the system captures real-time operational data directly from vessels, enabling continuous monitoring and reporting against regulatory thresholds.

Elsewhere, attention quickly focused on the pooling mechanism embedded within FuelEU Maritime. This allows fleets operating low or zero-emission vessels to offset higher emissions from sister ships, reducing or even eliminating penalties. Several companies moved early to develop pooling services that could also be opened up to third-party participants. Among them was Ahti Pool, whose chief executive Risto-Juhani Kariranta discussed with The Motorship how pooling could become a commercial tool as well as a compliance mechanism.

More broadly, regulatory compliance support emerged as one of the fastest-growing areas of maritime software in 2025. OceanScore, later shortlisted for a Motorship Award, demonstrated how a combination of software engineering capability and regulatory expertise could deliver tangible value. Despite being a relatively young entrant to the sector, the company rapidly built a client base covering both EU ETS and FuelEU Maritime, reflecting the urgency with which owners sought practical solutions as EU greenhouse gas intensity limits began to apply to ships trading in EU and EEA waters and operators commenced formal fuel tracking and reporting.

April 2025

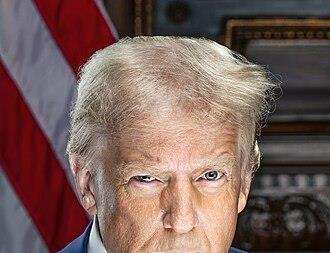

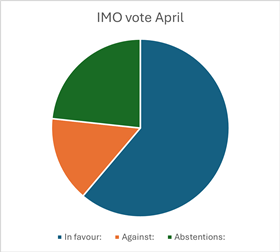

Attention shifted back to the global stage in April as the IMO’s Marine Environment Protection Committee met against a backdrop of growing geopolitical tension. Discussions around mid-term greenhouse gas measures highlighted deep divisions between Member States, particularly over the role and design of global market-based mechanisms.

The stance taken by the United States was widely seen as influential, shaping negotiations on carbon pricing and revenue redistribution, while other blocs pushed for faster and more prescriptive measures. Although no decisive breakthroughs were achieved, the meeting underlined how political considerations were becoming inseparable from technical debate, adding uncertainty for owners attempting to align fleet strategies with an evolving regulatory landscape.

June 2025

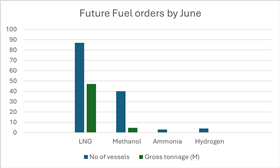

By mid-year, investment signals from the market offered a more mixed picture. Newbuild ordering was down slightly year-on-year by the end of the first half, reflecting ongoing caution around capital allocation and fuel choice. At the same time, there were clear signs of momentum building behind alternative fuel projects, particularly those linked to hydrogen, methanol and ammonia.

Several owners appeared to be advancing fuel strategy decisions in anticipation of greater regulatory clarity later in the year, widely expected around October. Classification society data, including analysis published by DNV, pointed to a growing number of dual-fuel and fuel-ready designs, suggesting that while some investment was being deferred, strategic positioning for future fuels was well under way.

September 2025

By September, regional decarbonisation initiatives were continuing to expand, often in parallel rather than in coordination with IMO discussions. EU measures progressed alongside schemes emerging across the Asia-Pacific region and at national level, reinforcing concerns about regulatory fragmentation.

For global operators, the risk of overlapping and sometimes conflicting requirements became increasingly apparent. While regional initiatives were credited with maintaining momentum in the absence of global agreement, they also added complexity to compliance planning and fuel strategy, particularly for vessels trading across multiple jurisdictions.

October 2025

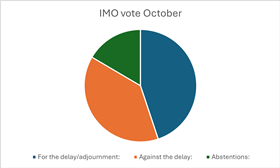

The focus returned to the IMO in October as negotiations intensified on the proposed Net-Zero Framework. Member States debated both the structure of the framework and the practicalities of its implementation, including timelines, enforcement mechanisms and the interaction with existing regional measures.

Although no final adoption was achieved, the discussions were widely seen as laying important groundwork for future agreement. For many in the industry, however, the lack of firm outcomes reinforced the need to plan amid uncertainty, balancing long-term decarbonisation goals with near-term regulatory exposure. The US, despite absent from the meeting, seemed to have a crucial influence on the outcome.

December 2025

As the year drew to a close, attention increasingly turned towards the regulatory milestones looming in 2026. Owners, shipyards and equipment suppliers used the final months of 2025 to align strategies, focusing on practical compliance pathways and the availability of fuels that could meet both regulatory and commercial requirements.

Rather than signalling a slowdown, the mood was one of cautious consolidation. The emphasis shifted from headline announcements to execution, with many stakeholders acknowledging that the coming years would be defined less by pledges and more by the ability to integrate new fuels, technologies and compliance systems into everyday operations, although a lack of a global standard may make those aims difficult to achieve.