Last year I wrote piece on the true cost of the Trump trade where I pointed to US maritime policies having an impact on shipping companies across the board.

Having revisited the theme and reading numerous analysts notes, it seems that there’s a stark dichotomy between two sections of the shipping market, shipowners and the companies providing equipment to them.

Using investment terms, the reason why companies like Hapag Lloyd have had a worse time in share price terms than marine technology companies like Wärtsilä is due to differing exposure to trade risk versus structural investment drivers. This is to say that trade tariffs impact sentiment towards container lines as they are directly impacted by container demand, especially on the transpacific and Asia–Europe routes. Even if underlying demand is still there, the threat is enough to dent confidence in this sector according to analysts from major investment banks like Jefferies, HSBC, Citi, JPMorgan and Bank of America.

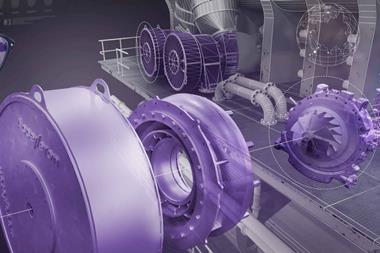

But regardless of a downturn in freight demand, shipowners need to keep their fleets ship shape, as it were, and with regulations increasingly demanding emissions reduction, companies specializing in this seem to be on the ascendancy. Hapag Lloyd is down over 10% in share price terms in a year, whereas Wärtsilä has rallied by over 80% in the same time period.

Nordic brokers including SEB, Nordea and Danske Bank, all of which closely follow Wärtsilä, have highlighted the company’s high exposure to aftermarket services and lifecycle agreements. These revenues are often described in analyst notes as “recurring”, “defensive” or “non-discretionary”, driven by mandatory maintenance, class requirements and fuel-efficiency upgrades rather than trade volumes. Indeed, a statement by Roger Holm, president of Wärtsilä, issued a statement before Christmas signalling the company’s focus on lifecycle services which seems to have been well received by the markets.

It’s not just major engine manufacturers that have enjoyed a degree of insulation from aggressive maritime policies, Swiss-listed turbocharger maker Accelleron has also made hay, up by over 40% in a year, while the shipowners using its products have slumped. Again, the company is a benefactor of what analysts at Kepler Cheuvreux, SEB and JPMorgan describe as a “regulation-driven capex cycle”. It might even be said that trade disruption has allowed shipowners time to retrofit existing ships, rather than invest in newbuilds which given current market uncertainty, seems to be prudent.

Much has been said about last October’s IMO stalemate over its plans to implement its Net Zero Framework but given existing regulations by bodies including the EU, shipowners have to act now to avoid costly fines. While introducing future fuels is crucial for reaching the IMO’s target of net zero by 2050, there are many ways to increase ship efficiency and thereby reduce emissions and there is a wide remit of companies involved in the technology to do so.

While it may sound a bit crude, one rule that has governed my writing over the years is “follow the money” as capital flows into companies by institutional investors are usually highly researched and often a decent indicator of what’s happening. This not meant as an investment or stock pick piece, moreover its meant as a possible explanation, backed by both generalist and specialist marine brokers, to explain why shipowners have been hit by trade tariffs whereas as OEMs supplying their fleets have thrived. The number of new entrants into areas such as wind-assisted propulsion compound this idea that while future fuels may not enter the maritime space as soon as many hoped, other areas of efficiency driving measures seem to be popular, with a mix of small start-ups and divisions of multinationals like Alfa Laval all entering the fray. One thing is certain, this year will be interesting.